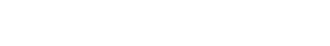

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 4/29/2024 – 5/6/2024

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* Citi chief U.S. economist Andrew Hollenhorst sees a hard landing in the US economy. He believes inflation and the labor market will weaken enough that the Federal Reserve will cut benchmark rates four times this year, far more than the one or two cuts Wall Street expects. (Bloomberg)

* Shanghai’s heritage properties are hardly typical, but all across China, the appeal of so-called second-hand homes appears to be rising in what could herald a seismic shift for a crisis-hit Chinese real estate sector dominated for decades by the trade in new-build homes. Chinese consumers simply don’t trust developers anymore. (FT)

* For decades, the rapid inflow of migrants helped countries including Canada, Australia and the UK stave off the demographic drag from aging populations and falling birth rates. In Australia, the inflow of roughly one million people (3.7% of the population) since June 2022 helped plug a chronic shortage of workers in industries such as hospitality, aged care and agriculture. In the UK – an economy near full employment – arrivals from Ukraine, Hong Kong and elsewhere have made up for a lack of workers after Brexit. That’s now breaking down as a surge of arrivals since borders reopened after the pandemic runs headlong into a chronic shortage of homes to accommodate them. (Bloomberg)

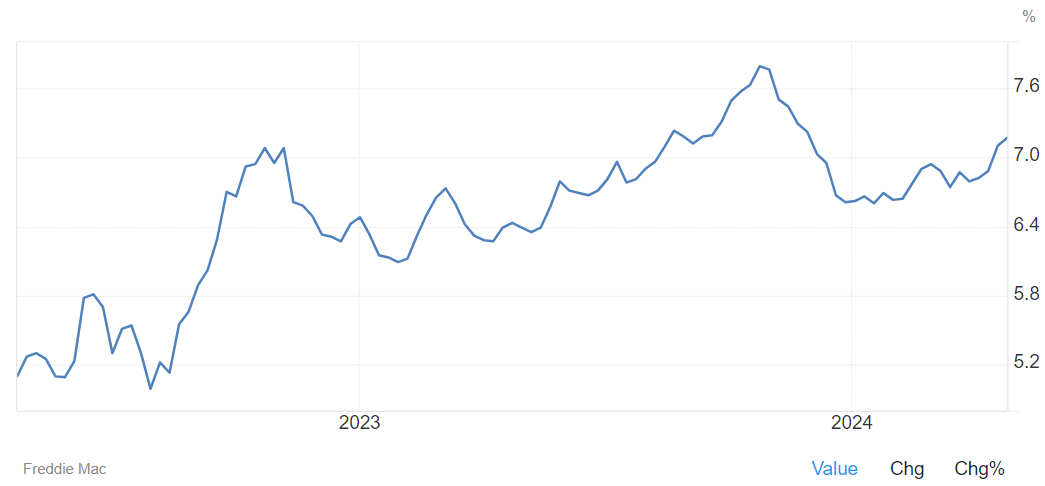

Mortgage Rate Updates

The average rate for a 30-year fixed mortgage rose 5bps from the previous week to 7.22% as of May 1st, the highest since late November. In the same period last year, the average rate for a 30-year fixed mortgage was 6.39%. “Mortgage rates continued their ascent this week,” stated Sam Khater, Freddie Mac’s Chief Economist. “On average, more than one-third of home sales for the entire year occur between March and June. With two months left of this historically busy period, potential homebuyers will likely not see relief from rising rates anytime soon. However, many seem to have acclimated to these higher rates, as demonstrated by the recently released pending home sales data coming in at the highest level in a year.”.

Source: Freddie Mac