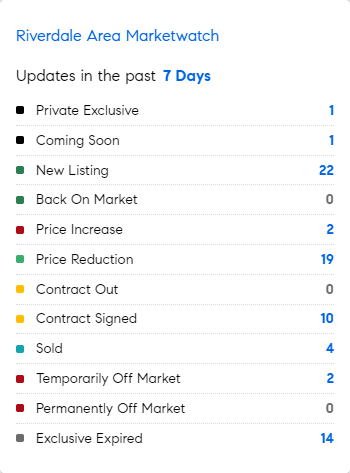

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 5/27/2024 – 6/3/2024

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* Up to $68 million in coins is thrown away each year in the US…..in case you are looking for some free money: look down on the street past your i-phone screen….

* 80 out of the 100 largest US cities saw rent increases in May, but only 43 cities have positive year-over-year rent growth. The vacancy rate is at 6.7%.

* There IS one window AC unit that is actually better than others: Midea’s U-Shaped Air Conditioner keeps most of the hardware outside your window, making it much quieter than standard window units. An inverter-driven, variable-speed compressor lets the unit turn itself down to run at a “low” setting, instead of constantly cycling between either full power or no power. That makes it more energy efficient, and better at holding steady, comfortable temperatures and humidity levels. 8,000 BTU’s for under $400.(WSJ)

* Real disposable incomes have risen only modestly over the past year. The saving rate now stands at a 16-month low as households have mostly exhausted the extra pile of cash they squirreled away during the pandemic. In turn, many Americans are increasingly relying on credit cards and other sources of financing to support their spending. All this could lead to a FED pivot…. (BLOOMBERG)

* The 2.7% unemployment rate in the booming Miami metro area is among the lowest in the country. But inflation was higher than in any other major metro area in April, and housing costs have doubled in just 6 years. Wages have been rising—but not enough to keep up with prices. This encapsulates the dilemma of the FED who want to keep people employed and prevent prices rising by more than 2% annually simultaneously. Not easy! (WSJ)

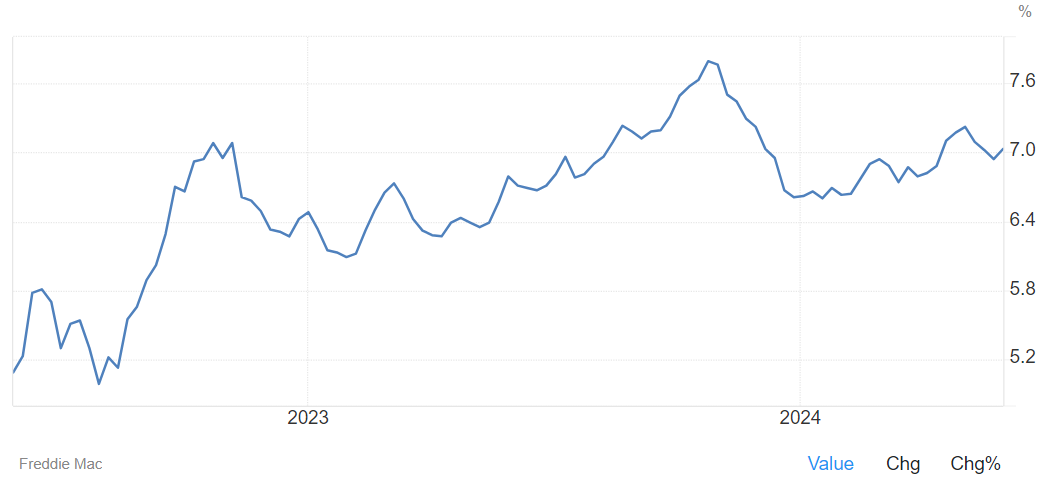

Mortgage Rate Updates

The average rate for a 30-year fixed mortgage rose by 9bps to 7.03% as of May 30th. The increase was in line with the jump in long-dated Treasury yields in the period, reflecting expectations that sticky inflation may force the Fed to leave rates higher for longer. The average for the 30-year mortgage rate was at 6.79% in the corresponding period of the previous year. “Following several weeks of decline, mortgage rates changed course this week,” said Sam Khater, Freddie Mac’s Chief Economist. “More hawkish commentary about inflation and tepid demand for longer-dated Treasury auctions caused market yields to rise across the board. This reality, as well as economic signals that have moved sideways over the last few weeks, have resulted in mortgage rates drifting higher as markets continue to dial back expectations of interest rate cuts.”.

Source: Freddie Mac