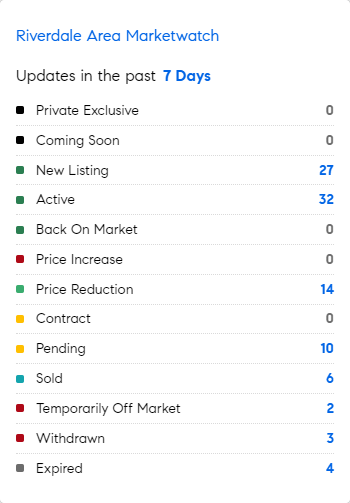

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 6/17/2024 – 6/24/2024

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* The number of American homeowners without insurance has more than doubled to 12% from 5% in 2019. The spike in uninsured homes is being driven by a dramatic rise in the cost of coverage. Higher premiums are putting a strain on households already struggling to afford life’s staples. Some bet that something bad won’t happen to them. Some bet that government will rescue them. The fewer people paying into the insurance system the higher rates are bound to go for everyone else? (USA TODAY)

* Brookfield embarked on a plan to convert several stalling malls into mini-cities with shops, restaurants, food stores, apartments, doctor’s offices, etc…..The process has been excruciatingly slow….why? Getting approvals from cities and towns is a lengthy and sometimes contentious process, often because of community pushback. (WSJ)

Mortgage Rate Updates

The average rate for a 30-year fixed mortgage fell by 8bps from the previous week to 6.87% as of June 20th, the lowest in two months, according to Freddie Mac. The move was aligned with another drop in long-dated Treasury yields in the period, as a softer inflation print for May raised hopes that the Federal Reserve will cut benchmark borrowing costs this year. The average rate for a 3-year mortgage was 6.67% in the corresponding period of the previous year. “Mortgage rates fell for the third straight week following signs of cooling inflation and market expectations of a future Fed rate cut,” said Sam Khater, Freddie Mac’s Chief Economist. “These lower mortgage rates coupled with the gradually improving housing supply bodes well for the housing market. Aspiring homeowners should remember it’s important to shop around for the best mortgage rate as they can vary widely between lenders.”.

Source: Freddie Mac