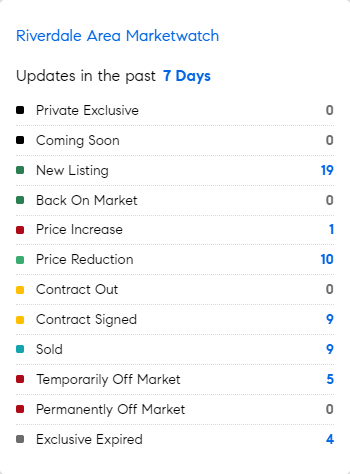

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 7/22/2024 – 7/29/2024

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* COMPASS agents and all in the family of COMPASS handles have a collective volume of followers estimated around…..85 MILLION! “Keeping Up With COMPASS”, perhaps?

* Of all things, real estate seems to have been the biggest victim of higher interest rates: Rate hikes had the clearest impact on the US housing market, where Fed policy not only spurred a surge in borrowing costs but also a run-up in home prices. A measure of home affordability is near its lowest level in more than three decades of data. Real-time data” suggests that consumers are starting to slow down. Reports from consumer staples names or financials show consumers shift to value-oriented goods . . . or lower-end consumers taking more loans and spending less. (Bloomberg/FT)

* If you read the headlines in the New York Post you could easily believe that New York City has a crazy high homicide rate……the facts/data show the exact opposite: Manhattan and Brooklyn’s homicide rates are less than half those of Buffalo, Portland, Nashville, Dallas, Denver, Houston, Jacksonville, Cleveland, Richmond and about 20+ other US cities….

* Despite 39% of U.S. families renting in 2022, nearly 8 million qualified as “income mortgage-ready.” This means they could likely handle a mortgage payment for a typical home in their area without exceeding 30% of their income. We urgently need to educate the consumer better as it relates to finances. (Benzinga)

Mortgage Rate Updates

The average rate for a 30-year fixed mortgage slightly increased by 1 basis point to 6.78% as of July 25th, remaining near its lowest level since mid-March, according to Freddie Mac. The stability comes as the market continued to fully price in an expected Federal Reserve interest rate cut at its September meeting. A year ago, the average rate for a 30-year mortgage was 6.81%. “Mortgage rates have essentially remained stable compared to last week but have decreased by nearly half a percent from their peak earlier this year,” noted Sam Khater, Freddie Mac’s Chief Economist. “Despite these lower rates, buyers continue to hesitate, as evidenced by declining new and existing home sales data.”.

Source: Freddie Mac