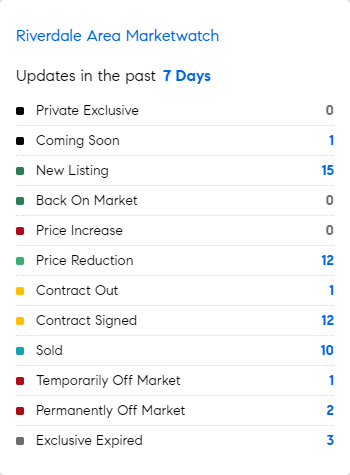

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 8/5/2024 – 8/12/2024

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* Which states are the most expensive MONTHLY COST wise? A recent study considered the following: Utilities, Cable and phone, Mobile phone, Auto loans, Auto insurance, Life insurance, Health insurance, Alarm and security, Rent and Mortgage. The most expensive state? Hawaii. As is to be expected from a series of islands! This was followed by California, Massachusetts, New Jersey, Maryland, Washington, New York, Connecticut, Colorado and New Hampshire. The least expensive were: West Virginia, Mississippi, Arkansas, Kentucky, Oklahoma, Indiana, Alabama, Missouri,

South Dakota, and Kansas. The study did not factor incomes, purely expenses. (CNBC)

“It takes six or seven years to get your

permits to build in Malibu. If you’re

older, who has that much time to waste?

People want instant satisfaction.”

– Chris Cortazzo, COMPASS (Bloomberg)

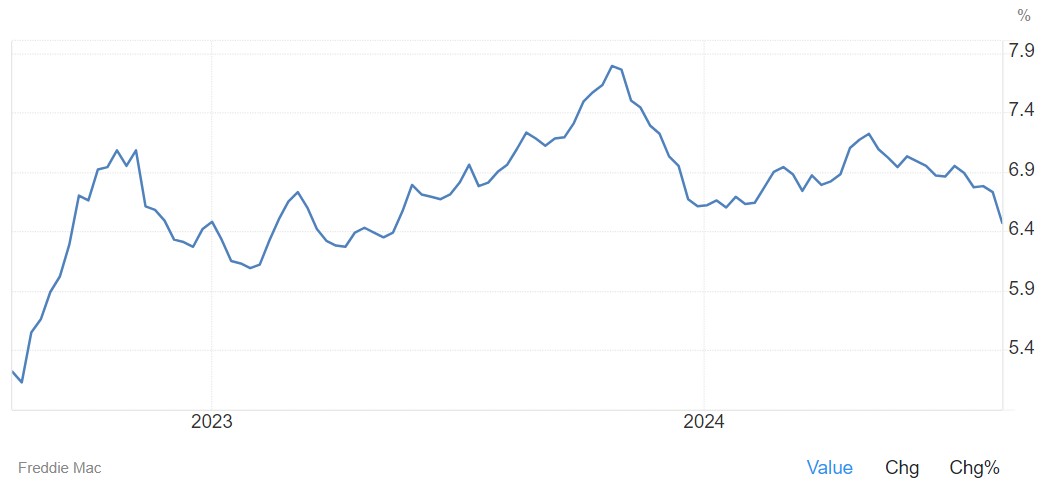

Mortgage Rate Updates

The average rate for a 30-year fixed mortgage plunged by 26 basis points to 6.47% as of August 8th, reaching its lowest level since mid-May 2023, according to Freddie Mac. This decline occurred alongside Treasury yields dropping to one-year lows, as heightened fears of a U.S. recession fueled a flight to safety and spurred risk-off sentiment in the market. “Mortgage rates plunged this week to their lowest level in over a year, following what appears to be an overreaction to a less-than-favorable employment report and financial market turbulence, despite the economy remaining on solid footing,” noted Sam Khater, Freddie Mac’s Chief Economist. “The drop in mortgage rates increases prospective homebuyers’ purchasing power and should stimulate interest in making a move. Additionally, this decline in rates is providing some existing homeowners the opportunity to refinance, with the refinance share of mortgage applications reaching nearly 42 percent, the highest since March 2022.”.

Source: Freddie Mac