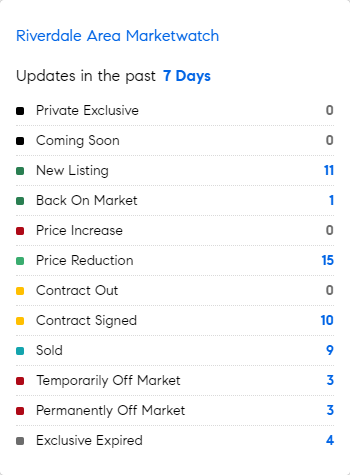

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 8/12/2024 – 8/19/2024

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* Water consumption by dozens of facilities in Virginia’s “data centre alley” has jumped by almost two-thirds since 2019. Demand for computing infrastructure is set to “explode” due to A.I. Virginia is home to the world’s largest concentration of data centres, including facilities used by Big Tech groups Amazon, Google and Microsoft. The vast warehouses full of computers and networking gear used at least 1.85 billion gallons of water in 2023, up over 55% from 1.13 billion gallons used in 2019. US data centres consumed more than 75 billion gallons of water in 2023. (FT)

* Goldman Sachs has cut its probability forecast for a U.S. recession to 20% from 25%, shortly after raising it from 15%. (CNBC)

* Iron Ore – an important building material used to make steel – is seeing pricing down over 55% from its high’s in July, 2021 as China’s construction industry struggles. This sharply lower price could help reduce construction costs in the US for bridges, buildings and other infrastructure.

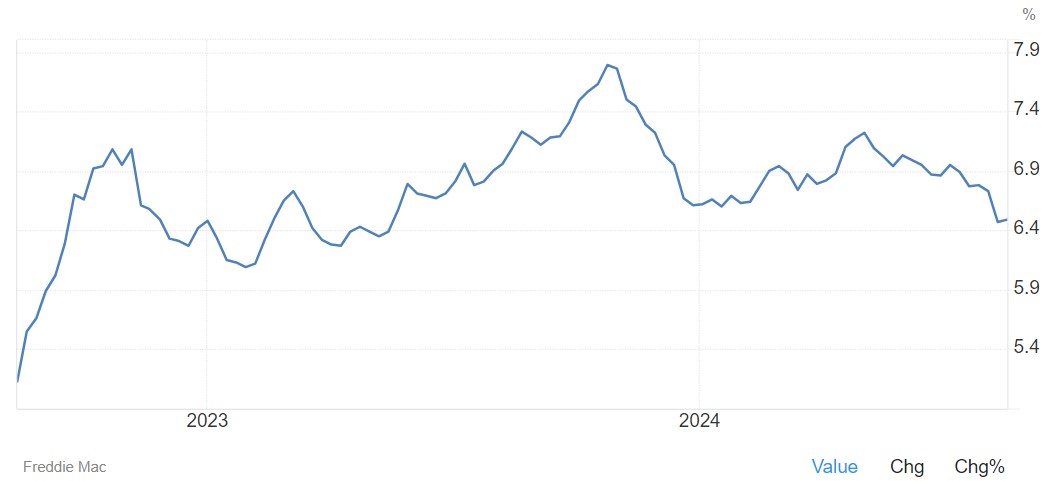

Mortgage Rate Updates

The average rate on a 30-year fixed mortgage was broadly stable at 6.49% as of August 15th, 2bps above the one-year low in the prior week but remaining 24bps below levels from the end of July. The decline in the period matched the decrease in long-dated Treasury yields, as lingering growth concerns in the US drove investors to pile on safer fixed-income assets. In the corresponding period of the previous year, the rate on a 30-year benchmark mortgage was 7.09%. “While rates increased slightly this week, they remain more than half a percent lower than the same time last year,” said Sam Khater, Freddie Mac’s Chief Economist. “In 2023, the 30-year fixed-rate mortgage nearly hit 8 percent, slamming the brakes on the housing market. Now, the 30-year fixed-rate hovers around 6.5 percent and will likely trend down in the coming months as inflation continues to slow. Lower rates are good news for potential buyers and sellers alike.”.

Source: Freddie Mac