MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 11/5/2024 – 11/12/2024

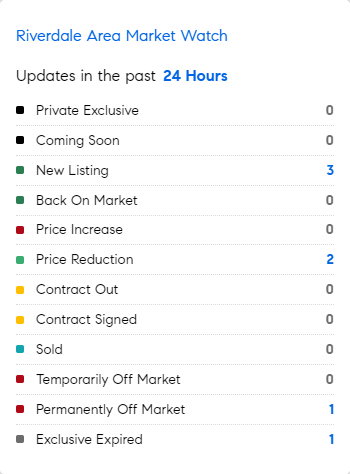

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* Regardless of the New York Post’s gleeful daily headlines proclaiming the abandonment of New York’s wealthy, New York City still remains home to the most billionaires of any American city, with 41, worth a collective $517.5 billion. Los Angeles and San Francisco are second with 15 billionaires each. (FORBES)

* Zillow reported 3rd-quarter revenue of $581 million, up 17% YOY.

* Small Reminders: Many ultra-luxe brands are opting for much smaller, much more discreet logos on their products, just enough to remind you – and everyone watching – that what you are wearing/driving/living in was VERY EXPENSIVE! Achieving status – and displaying it to the world – is human…. we all do things differently

* Daniel Lurie is the first political outsider – and moderate – to win a mayoral race in San Francisco since 1911 (56% of the vote). Lurie promised clean and safe streets for all, tackling the drug and behavioral health crisis, shaking up the corrupt and ineffective bureaucracy, building enough housing to turn around the affordability crisis, breathing life back into downtown, and ensuring small businesses thrive….. I’m betting ON San Francisco’s rise! (Other mayoral hopefuls take note!)

* Want to learn all about buying a ranch? Now there is an amazing monthly PODCAST from COMPASS luminaries Rick Doak and Tonya Currie of the Lifestyle Ranch & Home Group …..listen HERE.

* UP-zoning is nothing new: 95% of the land on Fifth Avenue between 59th and 96th Streets in Manhattan was occupied by mansions……today the vast majority are larger apartment buildings. (NY TIMES)

Mortgage Rate Updates

The average rate on a 30-year fixed mortgage rose to 6.79% as of November 7th, 2024, reaching its highest level in nearly four months. This uptick comes as markets are worried that a Trump presidency and a Republican-controlled Senate could fuel inflation and budget deficits through expansionary policies like tax cuts and tariffs, limiting the Fed’s ability to cut rates. “Mortgage rates continued to inch up this week, reaching 6.79 percent. It is clear purchase demand is very sensitive to mortgage rates in the current market environment. As soon as rates began to rise in early October, purchase applications fell and over the last month have declined 10 percent,” said Sam Khater, Freddie Mac’s Chief Economist.

Source: Freddie Mac