MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 11/19/2024 – 11/25/2024

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* Maybe the real estate profession can learn a thing or two from the Crypto-bro’s on how to influence government legislation? In total, crypto-related PACs and other groups tied to the industry reeled in over $245 million and nearly 300 pro-crypto lawmakers will take seats in the House and Senate giving the sector unprecedented influence over the legislative agenda. If every one of the 1.5 million real estate agents donated $163. (CNBC)

* A recent survey revealed that more than 20% of “Ultra-High Net Worth Individuals” (UHNWIs) planned to purchase residential real estate in 2025. Nearly that number is expected to invest in commercial real estate, which is rebounding after a slow 2023. (FT)

“It takes a particular kind of madness —

it’s not for everyone.”

– Robert O’Byrne, speaking about the massive undertaking to renovate a large Irish manor house…. (FT)

* Qualified personal residence trusts (QPRTs) effectively freeze the value of a property for tax purposes. The homeowner puts the primary residence or vacation home in the trust and retains ownership for however many years they choose. When the trust ends, the property is transferred out of the taxable estate. The estate only has to pay gift tax on the value of the property when the trust was formed even if the home has appreciated by millions in value. QPRTs have become more popular in the past year as interest rate hikes confer another tax benefit. There are a few strings attached, so clients must consult with an attorney/financial advisor.

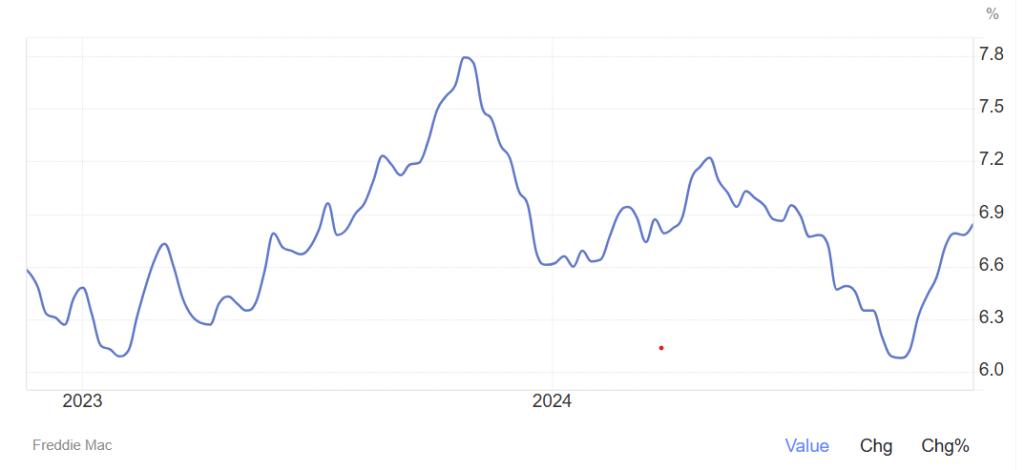

Mortgage Rate Updates:

The average rate on a 30-year fixed mortgage rose to 6.84% as of November 21st, 2024, marking their highest level in four months. The rise aligns with Fed Funds futures reflecting a growing market shift, with fewer investors expecting a rate cut next month, as persistent inflation and signs of economic strength reinforce the case for a hawkish Federal Reserve stance. “Mortgage rates ticked back up this week, continuing to approach 7 percent. Heading into the holidays, purchase demand remains in the doldrums. While for-sale inventory is increasing modestly, the elevated interest rate environment has caused new construction to soften,” said Sam Khater, Freddie Mac’s Chief Economist.

Source: Freddie Mac