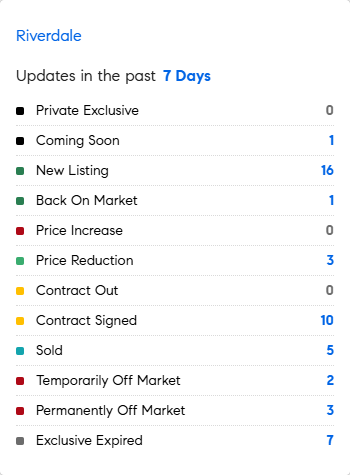

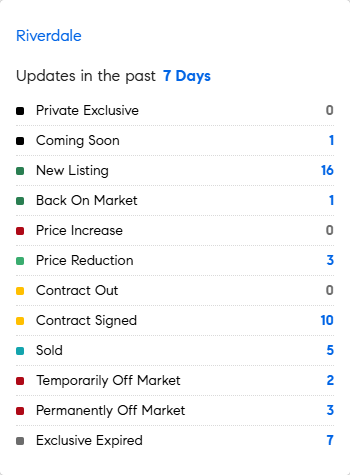

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 3/10/2025 – 3/17/2025

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* Wall Street is offering what are dubbed private rooms, gated venues that take the core benefit of a dark pool — the ability to hide big equity deals so they won’t impact prices — and add exclusivity, specifying exactly who can partake in any trade. More than 50% of all US stock trading now happens away from public exchanges…..I guess this is ok on Wall Street but not Main Street? No Clear Cooperation policies for Wall Street investments, just homes? Hmmmmm…..

* More taxes in the UK may not make housing more affordable…..buyers are scrambling to buy before stamp duties/taxes rise…. The Labour government, seeking to boost revenue and reduce a soaring budget deficit, is lowering the minimum threshold at which homebuyers pay stamp duty. First-time buyers face a 5% tax on the value of property over £300,000 from April, compared with a £450,000 threshold previously, while second-time homebuyers will pay a 5% tax on property worth over £125,000, down from £250,000. Will home prices adjust down to accommodate this extra tax or rise as more people rush to buy? Will there be fewer sales thereby resulting in higher rates, but lower net tax collections?

* In 2016 New York collected about $2,6 billion in property transfer taxes. In 2024 – with raised rates – it was a little over $3 billion, indicating a marginal rise in tax collections. Would New York have netted more with lower/same rates?

* GEN Z is improving in multiple areas: their addiction to social media may be partially responsible for producing some upsides as follows:

- More frugal, more health-conscious

- Only around a third drink regularly

* 40% of new Ferrari buyers are under the age of 40 demonstrating how wealth creation is happening at a young age, not to mention the impact of wealth redistribution generationally. (CNBC)

Mortgage Rate Updates:

The average rate on a 30-year fixed mortgage backed by Freddie Mac rebounded to 6.65% on March 13, breaking a seven-week streak of easing and rising from the lowest levels seen since early December. “Despite volatility in the markets, the 30-year fixed-rate mortgage remained essentially flat from last week. Mortgage rates continue to be relatively low versus the last few months, and homebuyers have responded. Purchase applications are up 5% as compared to a year ago. The combination of modestly lower mortgage rates and improving inventory is a positive sign for homebuyers in this critical spring homebuying season.,” said Sam Khater, Freddie Mac’s Chief Economist

Source: Freddie Mac