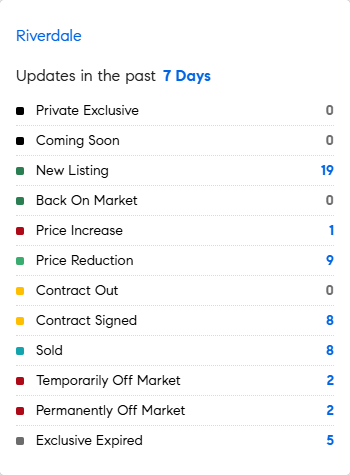

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 1/27/2025 – 2/3/2025

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* Sometimes history shows how policies enacted in the past might play out today: How have trade tariffs played out in the past? The Smoot-Hawley Tariff Act of 1930 increased import duties in the US intended to protect American farmers and businesses by raising the prices for farm goods.

The law, intended to isolate the U.S. economy from other struggling markets, increased the cost of imported goods, making it more expensive for foreign countries to sell their products in the U.S. The law led to a decrease in global trade and contributed to the deepening of the Great Depression. Is our US economy strong enough today to withstand these new tariffs? We will find out. US inflation is still closer to 3% than the Fed’s 2% target which will keep rates elevated.

* Almost 80% (21 out of 27) of REITs in the sector delivered increased shareholder dividends last year. The next biggest winner was the industrial sector, where 77% of REITs paid shareholders a higher dividend in 2024 than the previous year. (YAHOO FINANCE)

* Dubai is adding a new round of ostentatious mansions and penthouses priced between $60-120 million as developers court millionaires from around the world. The trappings are increasingly extravagant, such as a movable floor for a client’s swimming pool that rises to meld with the garden tiles during parties. What about a giant glass dome built in the center of a mansion meant to cover a pool and spa that can be retracted when the owners wanted to sun themselves? A 55 feet by 13 feet single pane of glass to embrace views with an underground room for the giant pane to descend into when lowered? A winding pool to allow residents to swim from the bar to the spa at the other end of the garden? Dubai’s market is bucking a global trend as prime residential prices slow or drop in many other international markets…..mostly driven by very low taxation policies. In 2024 435 homes priced $10 million and more sold in Dubai, reaching a record and surpassing New York and Hong Kong. Most buyers are coming from the UK, China, Russia, Pakistan and India. There are no real estate taxes in Dubai either…. (Bloomberg)

* The gold price is surging…..which usually happens as Gold has the perception as a safe-haven asset, leading to increased demand during times of economic uncertainty, geopolitical tensions, inflation: investors turn to gold to protect their wealth; essentially, when the market is volatile, gold prices often rise as people seek stability in the precious metal.

* 50% of the renovators surveyed by Houzz in 2022 who had set an initial budget said they’d overshot it, with 12% overspending by 25 – 49%, and 5% going over by more than 50%. (FT)

* A study of suburban households in the US between 1985 and 2013 by the behavioural economist Clément Bellet suggests that housing satisfaction has remained the same over that period, despite the amount of space per person increasing by around 50%. In the same way that above a certain threshold, a bump in salary has no effect on happiness, moving to a bigger house once it is above a certain size doesn’t increase wellbeing. We tend to have a honeymoon period for the first year or so, then satisfaction decreases, before levelling out to where it was before the move. (FT)

* Mark Wong of COMPASS Silicon Valley shares that

2025 kicked off with a bang in Silicon Valley! In January alone, at least 26 properties sold for $200,000 or more above the list price, with 16 surpassing $400,000 over asking. An early start and lots of multiple bids! (COMPASSinsights)

Mortgage Rate Updates:

The average rate on a 30-year fixed mortgage backed by Freddie Mac eased to 6.95% as of January 30th, declining for the second consecutive week from the highest level since early May 2024 of 7.04%. The decrease aligned with declining long-dated Treasury yields and the Federal Reserve’s indication that there is no rush to extend its cutting cycle after holding borrowing costs unchanged. “The 30-year fixed-rate has hovered between 6% and 7% for most of the last two and a half years. That trend continued this week, with the average rate remaining essentially flat at 6.95%. Driven by these higher rates and a persistent supply shortage, affordability hurdles still exist for many homebuyers and a significant number of them remain on the sidelines,” said Sam Khater, Freddie Mac’s Chief Economist.

Source: Freddie Mac