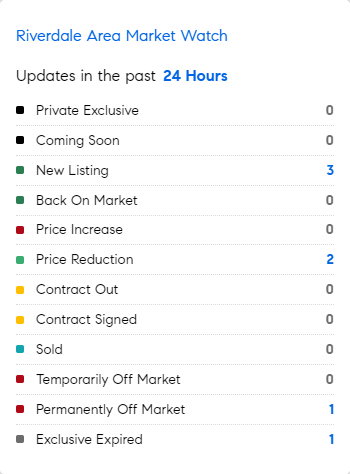

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 10/1/2024 – 10/7/2024

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* Many insurance deductibles are a percentage of the whole claim……so if you own a $5 million home, a 5% deductible could amount to $250,000. Two years after Hurricane Ian, nearly 50,000 claims remain unresolved, including more than 18,000 where no payments have been made. (WSJ)

* Standard renters insurance policies do not cover flooding. To protect your belongings from flood damage, you’ll need to purchase a separate flood insurance policy.

* More than 7 million adults of ages 65 and above rent instead of own their homes in the US: Renting in retirement years can be a positive because older people can avoid costly maintenance associated with the upkeep of a home. Renting also offers the flexibility to move vs. the complexity of selling a home…..but….unlike younger renters, adult renters in retirement years could be especially vulnerable to rent hikes because they are on fixed income. Maintenance costs, insurance and real estate taxes are not fixed either and tend to rise with the rate of inflation. (CNBC)

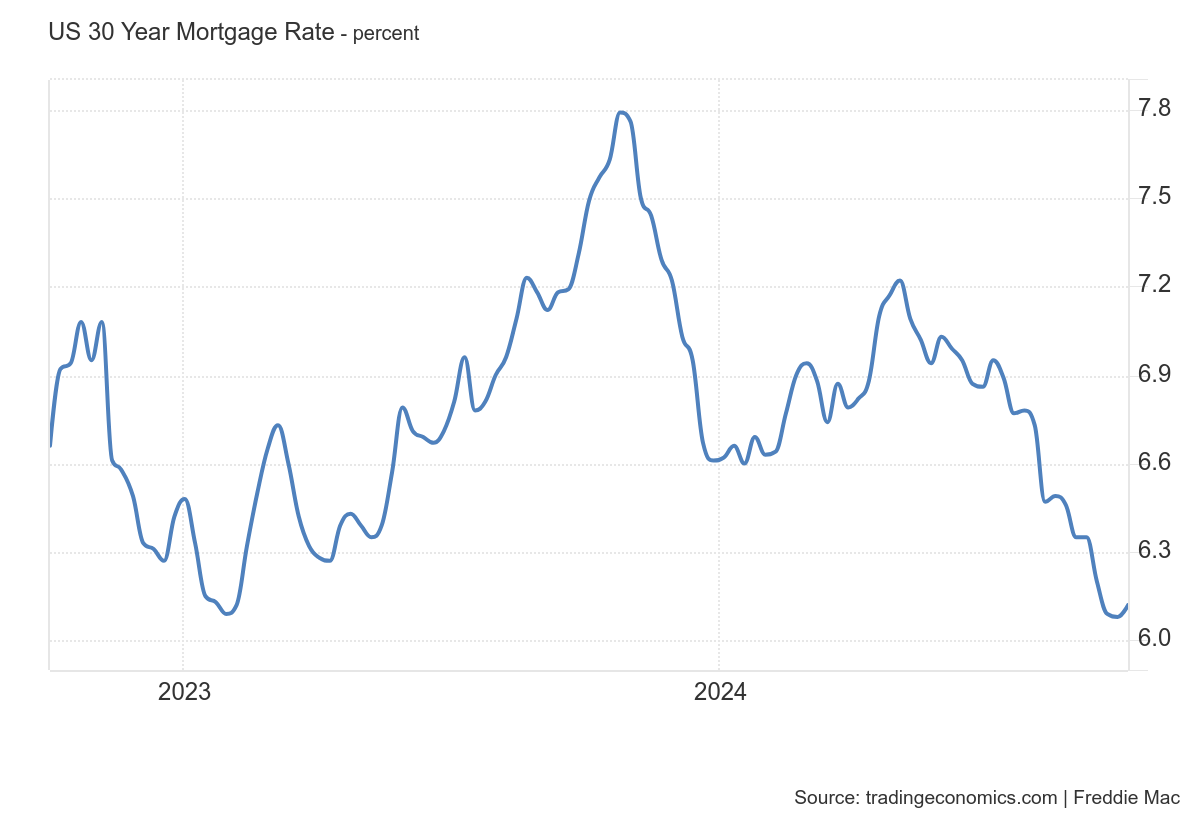

* Fixed rate mortgages are at a 6-week high…..but many buyers felt that mortgage rates would come down after the Fed cut its rate by .5% on 9/18.Many buyers said on 9/19 that mortgage rates will fall further this year because the Fed will cut again. Mortgage rates were actually LOWER when the Fed Funds was higher. There are many “rates” in the marketplace. Mortgage rates are impacted by a lot of factors, primarily the trading of mortgage-backed securities. Any guidance provided by the Fed is priced into mortgage rates long before the Fed releases their policy statement. Economic data influences MBS trading. The 2 most important reports each month will be CPI and the employment report. Stronger employment = higher MBS rates.

* When evaluating home insurance, don’t only evaluate replacement cost, also evaluate new local building codes that may require more costly construction methods and materials than simply replicating that which currently exists.

Mortgage Rate Updates

The average rate on a 30-year fixed mortgage increased to 6.12% as of October 3rd, rebounding from its mid-September 2022 low from last week when it averaged 6.08%, according to Freddie Mac. This increase coincides with rising long-dated Treasury yields, as strong labor market data reinforces confidence in economic resilience while the Federal Reserve signals smaller future rate cuts, dampening expectations for aggressive easing. “The decline in mortgage rates has stalled due to a mix of escalating geopolitical tensions and a rebound in short-term rates that indicate the market’s enthusiasm on rate cuts was premature,” said Sam Khater, Freddie Mac’s Chief Economist. “Zooming out to the bigger picture, mortgage rates have declined one and a half percentage points over the last 12 months, home price growth is slowing, inventory is increasing, and incomes continue to rise. As a result, the backdrop for homebuyers this fall is improving and should continue through the rest of the year.”

Source: Freddie Mac