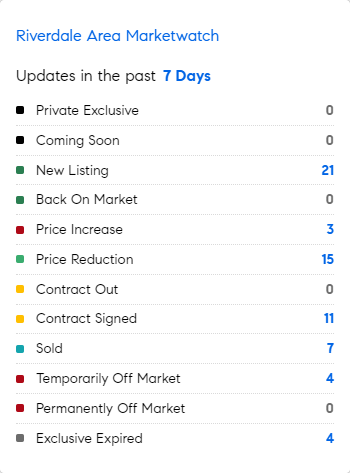

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 10/16/2023 – 10/23/2023

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* Ah, the things we DO have money for……Total Halloween spending is projected to reach $12.2 billion up from 2022’s $10.6 billion record. A record 73% will participate in Halloween-related activities this year, the survey of 8,084 consumers showed, up from 69% in 2022 and 72% in 2017.

* Kitchen islands took off in the US in the 1960s but, from around some time in the 1980s, the kitchen underwent a big bang, a hot stretch of time and space in which it slowly expanded to occupy almost the whole of the ground floor of some houses. The kitchen island has evolved, now some almost the size of studio apartments! Some are taller at barstool height while others drop to accommodate dining table height.

* Trash Power? More than 500 former US garbage dumps have been turned into energy projects that transform landfill gas into fuel. Gas collection systems vacuum out the landfill gas and send it to a purification plant, where it undergoes methane removal. New York City sells 1.5 million cubic feet of treated biogas from the Freshkills landfill to the local utility, which distributes it to Staten Island homes for cooking and heating. (The average American household uses 70,000 cubic feet of natural gas annually.). (Bloomberg)

* Around 400,000 landslides occur around the globe each year. When buying a home always check proximity to potential landslides from neighboring hills and how the topography may impact this. Mudslides may not impact homes but can cut of transportation lines and utilities. Between 1998 and 2017 landslides and mudslides affected nearly 5 million people worldwide and took the lives of more than 18,000 (World Health Organization). In contrast, wildfires and volcanic activity killed 2,400. Drought followed by heavy rains often triggers landslides.

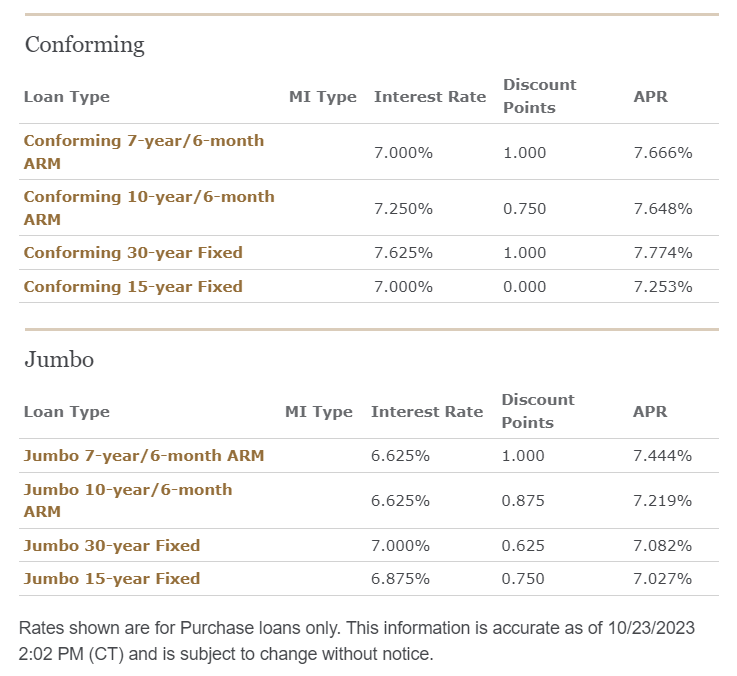

* A recent survey by WSJ Intelligence of more than 2,200 wealthy individuals found a majority planned to finance their next home purchase. Only 39% of the respondents—whose net worth averaged $4.76 million—planned to pay cash. Often wealthier people prefer borrowing – even at higher rates – instead of liquidating stocks to generate cash that may be depressed in value….and trigger capital gains taxes. If you can generate 15% returns on investments, borrowing at 7.5% is a good deal…. Buying a home with all cash and then financing aloting the cash towards investments allows you to write off all the interest for tax purposes too…. For many of the wealthiest, homes are a relatively minor portion of their assets. (BARRONS)

* The FED’s mission to reduce price escalation is failing in Silicon Valley where COMPASS’ Mark Wong reports that there were at least 33 properties that sold $200,000 or more over the list price in the month of September, including 9 properties that received more than half a million dollars over the asking price! Most of the properties attracted multiple offers in less than 2 weeks, in AS-IS condition with no contingencies.Despite the rising mortgage rates, the price of houses kept going up while the total sales decreased year over year. Definitely a very interesting time for the housing market, at least in the Silicon Valley area. Maybe at one point the FED realizes what everyone reading this already knows: higher rates = fewer sales = higher prices!

Courtesy of Melora Love, Wells Fargo