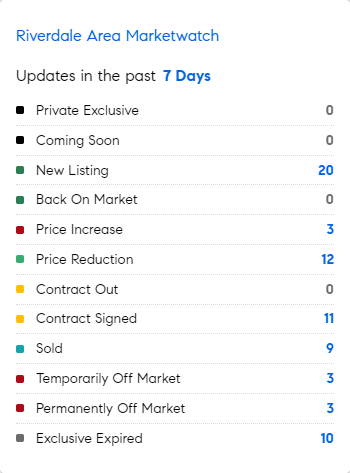

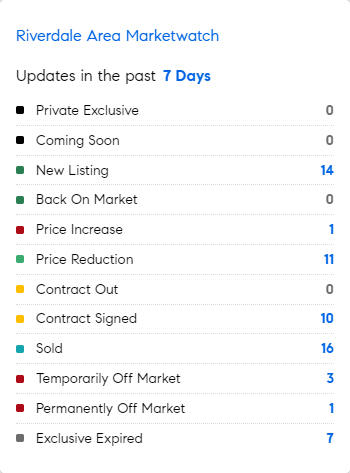

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 10/2/2023 – 10/9/2023

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* Baby boomers may be keeping the US economy afloat….. Americans aged 65 and up accounted for about 17% of the population but 22% of spending in 2022, the highest share since records began in 1972 and up from 15% in 2010. Americans age 70 and older now hold nearly 26% of household wealth, the highest since records began in 1989. Extended periods of patient saving and investing with compounding interest adds up over time. (WSJ)

* Houston, Dallas and Austin top the list of major U.S. cities with the highest office-vacancy rates, according to Moody’s Analytics. About 25% of their office space wasn’t leased as of the third quarter, more than double New York’s vacancy rate of 12% and San Francisco’s vacancy rate of 17%. (WSJ)

* The global elevator market will be over $146 billion by 2027…. super-tall buildings have 2 elevators sharing the same shaft and double-decker elevators. Passenger elevator can move up to 38 miles per hour. (WSJ)

* Household mortgage debt represented roughly 65% of U.S. consumers’ disposable income in the second quarter, compared to 100% before the Global Financial Crisis of 2008/9.

* The ratio of Americans’ mortgage debt to their real estate assets—also called loan-to-value—was just 27% in the second quarter, compared to over 40% in 2008 and roughly 50% in 2010. (Bank of America)

* Adjustable-rate mortgages can lead to higher default rates when interest rates rise, but they now represent less than 5% of total purchase and refinance loans, compared with over 35% at the peak of the pre-GFC housing cycle. (FORTUNE)

* Northeast of Houston, a real estate development offers plots of cheap land and unconventional loans for people who want to build their own houses, with few restrictions as development regulation is very limited. The Colony Ridge community, whose first residents moved in a decade ago, is now home to 40,000 people or more, with plans to more than double in size. The project developers offer loans without traditional credit scores. (NY TIMES)

Mortgage Rate Updates

The average rate on a 30-year fixed mortgage continued to climb, reaching 7.49% as of October 5th, 2023, a level last seen in 2000. This marks an increase from the previous week’s average of 7.31%, driven by the ongoing rise in US Treasury yields. “Mortgage rates maintained their upward trajectory as the 10-year Treasury yield, a key benchmark, climbed,” said Sam Khater, Freddie Mac’s Chief Economist. “Several factors, including shifts in inflation, the job market and uncertainty around the Federal Reserve’s next move, are contributing to the highest mortgage rates in a generation. Unsurprisingly, this is pulling back homebuyer demand.”

Source: Freddie Mac