MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 12/16/2024 – 12/23/2024

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* About a decade ago, the US debt was $18.15 trillion, and this is how much it has grown by the year compared to GDP growth:

2015: $18.15 trillion GDP: $18.295 trillion

2016: $ 19.57 trillion….up 7.8%. GDP: $18.8…..up 2.7%

2017: $20.2 trillion…. up 3.2%. GDP: $19.6…. up 4.2%

2018: $21.5 trillion….. up 6.4%. GDP: $20.65.. up 5.35%

2019: $22.7 trillion….. up 5.5%. GDP: $21.52…up 4.2%

2020: $26.9 trillion…… up 18.5%. GDP: $21.32..down 2%

2021: $28.4 trillion…….up 5.5%. GDP: $23.59…up 10.6%

2022: $30.9 trillion…….up 8.8%. GDP: $25.74…up 9.1%

2023: $33.16 trillion…..up7.3%. GDP: $27.35…up 6.25%

2024: $ 35.46 trillion….up 6.9%. GDP: $29……..up 6%

* S+P 500 2015: 2,052 2024: 6,600…..up 221%

DOW 2015: 17,700 2024: 42,300…up 139%

NASDAQ 2015: 4,200 2024: 21,600…up 414%

* US Median Home price: 2015: $ 222,000 2024: $420,000 (up89%)

* Total US Federal receipts/taxes 2015: $3.25 trillion. 2024: $5.08 trillion

(up 56%)

* Where the rich lead, the market — and even the economy as a whole — tends to follow? 2024 was the worst for the luxury industry since the great recession of 2007-09: While the super-rich are still spending as if they exist in a separate gravitational orbit, the aspirational consumers who make up the all-important “mass luxury” part of the market are scaling back. The luxury market shrank by about 50 million consumers over the past 2 years, in part because younger consumers are turning away from traditional luxury goods. Even the affluent are scaling back purchases of fine wines, jewellery, watches, and art means that a lot of asset-wealthy consumers are expecting a slowdown and some kind of market correction, even if we don’t see a full-blown trade war. Warren Buffet is sitting on $325 billion in cash alone. (FT)

“It’s beginning to cost a lot like Christmas!” – words heard around the globe….? 😂😂😂

* And this may summarize all of 2024 in a nutshell: yesterday’s earth-shattering news printed boldly in the New York Post and The Daily Mail – international bastions of truth and accuracy – that a $600 million Bezos wedding was about to occur in tony Aspen….has been denounced by Jeff himself as a blatant lie!

“Now lies can get ALL the way around the world before the truth can get its pants on. So be careful out there folks and don’t be gullible.”

……Maybe the best advice to all for 2025?

* If you thought New York or San Francisco were unaffordable, take a peek at Bozeman, Montana: Montana is the US state with the fastest growth of income inequality, as very wealthy people flock to the state, attracted by tax-haven policies. Montana is unique in providing a tax credit of 2% on all capital gains, whether invested in Montana or not. Montana does not have a sales tax, estate tax or inheritance tax.

* The US military – with our taxpayer dollars – has started many innovations that we use every day, including:

- Duct tape: A household staple

- The internet: Became a global network in the 1970’s

- GPS satellite navigation: Used to find your way around

- Microwave ovens: A common household appliance

Mortgage Rate Updates:

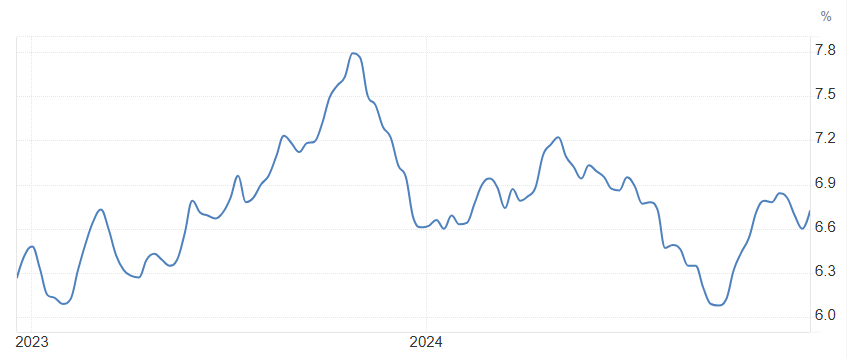

The average rate on a 30-year fixed mortgage increased to 6.72% as of December 19th, 2024, rebounding from the lowest level since mid-October of 6.6% after three consecutive weekly declines. The rise aligned with soaring US Treasury yields, as the Federal Reserve’s hawkish outlook, including fewer rate cuts in 2025, strong economic data, and concerns about persistent inflation, limited the urgency for looser monetary policy. “This week, mortgage rates crept up to a similar average as this time in 2023. For the most part, mortgage rates have moved between 6 and 7 percent over the last 12 months. Homebuyers are slowly digesting these higher rates and are gradually willing to move forward with buying a home, resulting in additional purchase activity,” said Sam Khater, Freddie Mac’s Chief Economist.

Source: Freddie Mac