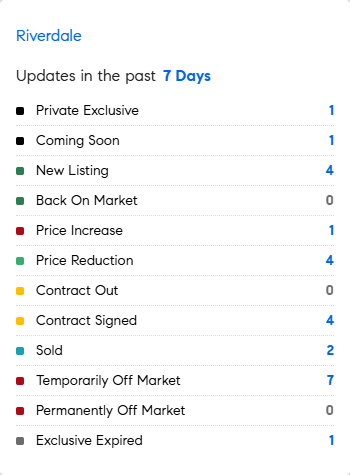

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 12/23/2024 – 12/30/2024

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* While we keep raving about the massive gains in the equity markets in 2024, we should be reminded that there was a MASSIVE correction in 2022 after the post-lockdown surge…..yup, as a reminder: The Dow fared the best of the indexes in 2022, but down about 8.8%. The S&P 500 sank 19.4%, and was more than 20% below its record high, while the tech-heavy Nasdaq tumbled 33.1%. Amazon halved, Tesla was down dramatically……about $30 TRILLION in market value was shed in 2022 after the massive 2020-22 surge. In case anyone says we are ‘due’ for a correction….?

* Look out for COMPASS Nashville’s Chad Jeffers who will be performing with Carrie Underwood on New Year’s Eve in NYC! He’ll be on ABC with Ryan Seacrest. Chad: you had better wear a COMPASS T-shirt! Maybe a sweatshirt? It’s cold here!

* The share of taxpayers facing estate taxes upon death has plunged from 6.5% in 1972 to 0.1% in 2021. The main reason: soaring exemptions, which under the 2017 tax cuts allow couples to give away up to $27 million without owing estate taxes. The ultra-wealthy also create trusts that reduce tax liabilities even further upon death. The biggest tax break may not be during your lifetime…..it’s at time of death! Some are suggesting an INHERITANCE tax….not an estate tax….. Only four developed countries (Denmark, South Korea, the U.S. and U.K.) tax estates. In contrast, 20 countries prefer to tax inheritances. The “step-up in basis” allows families to adjust the cost basis of an inherited asset to its current value. Some propose that heirs would receive the asset under the original basis so that way, when they sell the asset, they will be taxed on the full gain rather than just the appreciation after they receive the bequest. Many argue that all estates have already paid substantial taxes, but in reality many of the gains of the very wealthy have never been taxed.

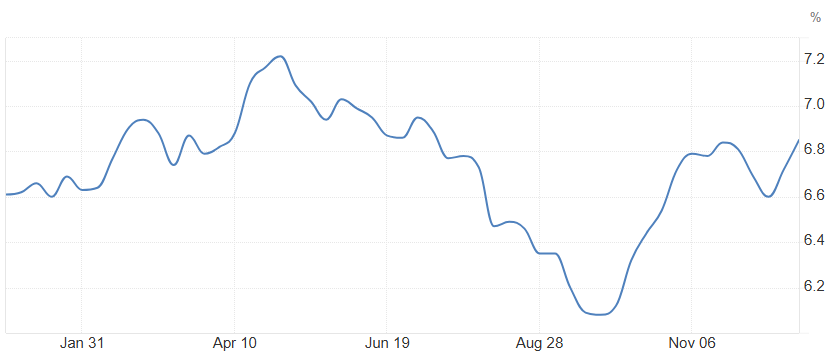

Mortgage Rate Updates:

The average rate on a 30-year fixed mortgage surged to 6.85% as of December 26th, 2024, rebounding for the second consecutive week to the highest level since early June. The rise aligned with soaring US Treasury yields, as markets adjusted expectations for fewer Federal Reserve rate cuts, influenced by hawkish projections, weaker economic data, and inflation concerns. “Mortgage rates increased for the second straight week, rebounding after a decline from earlier this month. While a slight improvement in new and existing home sales is encouraging, the market remains plagued by an overwhelming undersupply of homes. A strong economy can help build momentum heading into the new year and potentially boost purchase activity,” said Sam Khater, Freddie Mac’s Chief Economist.

Source: Freddie Mac