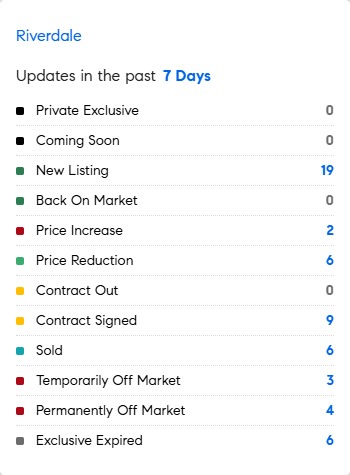

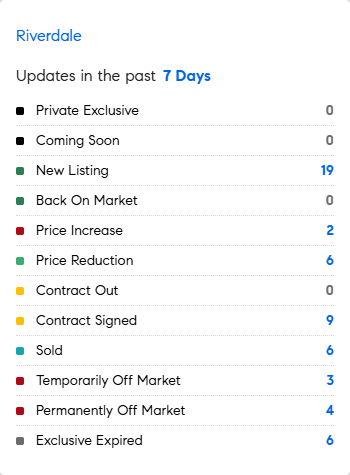

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 3/3/2025 – 3/10/2025

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* Bond traders are signaling an increasing risk that the US economy will stall with several factors potentially restraining the pace of growth. Traders have been piling into short-dated Treasuries, pulling the 2-year yield down sharply since mid-February, on expectations the Fed will resume cutting interest rates as soon as May to keep the economy from deteriorating. (Bloomberg)

* And here are Aristotle’s 10 virtues for happiness….

Identify what you fear and face it.

Learn what your “appetites” are, and get a handle on them. This can include substances and behaviors.

Find balance in how you use your time and spend your money: “Be neither a cheapskate nor a spendthrift.”

Give back generously, especially to people you care about and causes that matter to you.

“Focus more on transcendent things; disregard trivialities.”

Control your temper.

Don’t lie about anything, even to yourself.

Avoid “struggling for your fair share.”

Forgive people, for yourself.

Come up with your own rules for morality, and stick to them even when no one is watching. (Arthur Brooks)

* With the fluoride debate raging and now banned in Utah, here is where you can find out which counties in which states do and don’t use fluoride in their drinking water.

* BITCOIN is down over 23% off its high’s in less than 2 months…. another symptom of extreme volatility in some areas of the markets. (CNBC)

* Since 2019, US rents have increased 1.5x faster than income in most U.S. metro areas. Increased housing costs reduce labor mobility and productivity, as workers can’t afford to live in high-growth areas. When human capital can’t be invested in the regions offering the greatest returns, it dampens growth; one estimate says that lowering housing costs to increase the liquidity of human capital would increase GDP by $1.4 trillion. (Scott Galloway)

* The EB-5 Visa program – that looks like it will be replaced with a GOLD VISA program in 2027 costing 5X as much is not a huge moneymaker – contributes about $5 billion to the $28 trillion U.S. economy. This is often a source of cheaper financing for real estate:

94% of these visas are linked to real-estate investment. Will a much more expensive visa trigger price escalation on the high end fueling demand? (Yahoo News)

Mortgage Rate Updates:

The average rate on a 30-year fixed mortgage backed by Freddie Mac dropped to 6.63% as of March 6th, marking its seventh consecutive weekly decline from an eight-month high of 7.04%. “As the spring homebuying season gets underway, the 30-year fixed-rate mortgage saw the largest weekly decline since mid-September. The decline in rates increases prospective homebuyers’ purchasing power and should provide a strong incentive to make a move. Additionally, this decline in rates is already providing some existing homeowners the opportunity to refinance. In fact, the refinance share of market mortgage applications released this week reached nearly 44%, the highest since mid-December,” said Sam Khater, Freddie Mac’s Chief Economist.

Source: Freddie Mac