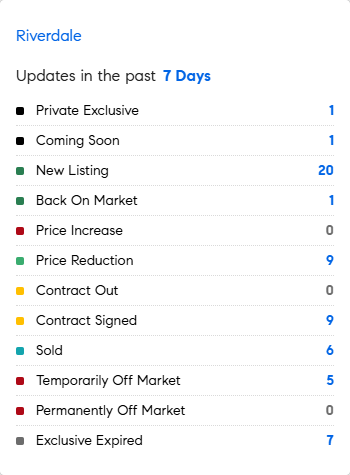

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 3/24/2025 – 3/31/2025

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* Sales at the collector car auctions at Amelia Island and Miami totaled a record $196.5 million this year, up from $183.8 million in 2024, especially impressive given that Bonhams didn’t hold an auction this year. The average sale price of $571,125 was an 8.25% improvement (LUXE-flation?) over last year’s average of $533,626. The sell-through rate – or number of cars at auction that ultimately sold – was a strong 88%.

* Worried your favorite ‘foreign brand’ car will cost much more? 75% of the TOP 20 most “Made in the US” car brands include Honda, Lexus, Toyota, Acura and Volkswagen, all perceived as ‘foreign’ brands. Tesla makes the most MADE IN THE US cars. But like Honda, it makes cars in other countries too: its Y and Model 3 cars sold in Canada are all made in China where it manufactures over 50% of all its cars. It has a huge plant in Germany too. Components for lots of stuff are made around the globe: Tesla has a Giga-factory in Markham, Canada (outside Toronto) making batteries. Will cars be rated on the percentage of components made in the US? (WSJ)

* The 10-year treasury dipped to 4.2% (good for mortgage rates) as fears of a slowing economy persist fueled by tariffs, trade wars and low population growth and immigration. Goldman Sachs predicts the US economy growing around 1%, inflation around 3.5% and higher unemployment around 4.5%….close to Stagflation. (CNBC)

* Imposing reciprocal tariffs on countries that have regularly run substantial trade surpluses with the U.S. poses a risk: these surpluses have enabled many of the countries to invest heavily in U.S. Treasury securities and U.S. corporate bonds, helping keep U.S. interest rates relatively low and bolstering US economic growth.

If countries respond to tariffs by reducing their investments, it woulddemand for U.S. debt securities, it could increase the interest rate that must be paid upon their issuance thereby slowing the U.S. economy. Some of the biggest foreign holders of U.S. corporate bonds are countries that have regularly run trade surpluses with the U.S. $300 billion of U.S. corporate bonds were held by Japan and $213 billion by Canada. (WSJ)

* Will the EB-5-replacing $5 million US immigration GOLD (green) CARD launch in 2 weeks as promised? Ultra-wealthy families around the globe especially in China, the Middle East, Southeast Asia, Latin America and Russia could buy several for their children and relatives. Immigration attorneys say the likely annual total of this will likely be “several thousand” rather than hundreds of thousands or millions. And sales will likely taper off after the first 2-3 years. The Commerce secretary said he has already pre-sold 1,000 of them. Will these people buy homes in the US? If they earn anything in the US they would be subject to US taxes.

* The top 10% of Americans – those worth $2 million or more – saw their wealth surge by nearly $10 trillion last year, to $107 trillion. Since the pandemic, their wealth has grown by about $37 trillion, an increase of 51%. The top 1% wealth soared by 63% since 2020, to $50 trillion. The bottom 90% of Americans also saw their wealth grow over the same period, surging by 60% to $52.55 trillion….almost the same rise as the top 1%. Was 2020-2024 the biggest wealth creation period in US history? (CNBC)

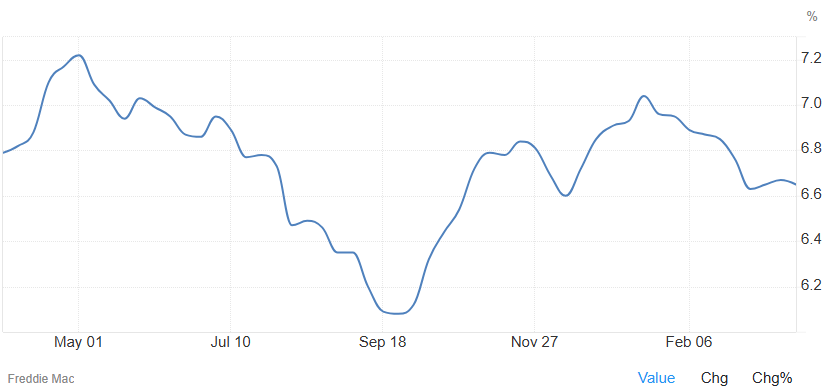

Mortgage Rate Updates:

The average rate on a 30-year fixed mortgage backed by Freddie Mac eased to 6.65% on March 27th, after rising for three consecutive weeks. “The 30-year fixed-rate mortgage ticked down by two basis points this week. Recent mortgage rate stability continues to benefit potential buyers this spring, as reflected in the uptick in purchase applications,” said Sam Khater, Freddie Mac’s Chief Economist.

Source: Freddie Mac