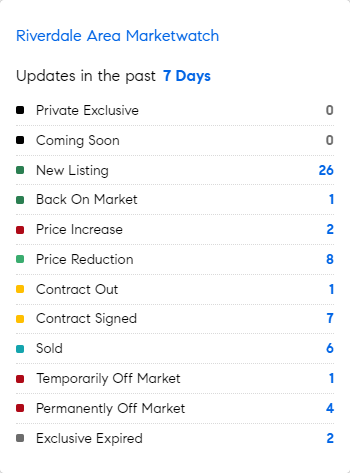

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 3/4/2024 – 3/11/2024

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* One good thing about higher rates? Higher rates may be acting as a disguised form of economic stimulus……baby boomers and retirees – and many others – have (MUCH) more income from their cash and bonds.. This has also fueled spending. Imagine a retiree with $1 million earning 2% in interest versus 5%…… in an economy reliant on consumer spending, I would bet this impacted the US’ GDP numbers and helped prevent a recession….

* Is it ironic that we decry corporations that close production facilities in a US town and move it to Mexico or any other area in the world that has much cheaper labor, but rarely decry when a corporation moves to another state within the US for the same reason? The harsh reality is that corporations exist to make maximum profits…..to remain competitive. And often that requires moving to where they can maximize those profits.

* Is 2025 the year the US’s $34 Trillion debt comes to haunt us? Neither large tax cuts, uncollected taxes nor fiscal stimulus or government abuse offer solutions…… how much debt would you need to recoup per person in the US? About $100,000…..per person!

Mortgage Rate Updates

The average rate on a 30-year fixed mortgage was at 6.94% as of February 29th, the fourth consecutive increase, 4bps above that from the prior week to the highest in over two months. The result was consistent with the high yields on long-dated US Treasury instruments in the period, holding their increases since the release of hot price and labor data for January. One year ago, the average rate on a 30-year fixed mortgage was 6.65%. “Mortgage rates continued their ascent this week, reaching a two-month high and flirting with seven percent yet again,” said Sam Khater, Freddie Mac’s Chief Economist. “The recent boomerang in rates has dampened already tentative homebuyer momentum as we approach the spring, a historically busy season for homebuying. While sales of newly built homes are trending in a positive direction, higher rates and elevated prices continue to pose affordability challenges that may leave potential homebuyers on the sidelines.”.

Source: Freddie Mac