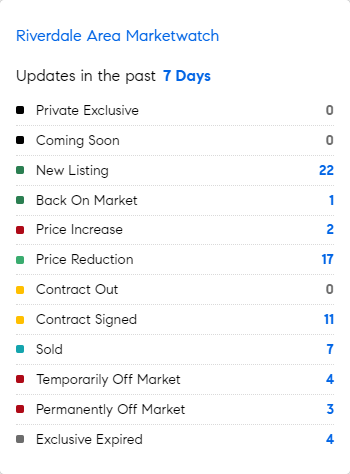

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 7/15/2024 – 7/22/2024

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* A recent evaluation of online estimates revealed some interesting results ….the Chicago home bought for $750,000 in 2017 had a Zillow Zestimate value of $1,002,900 as of mid-July, more than 40% above the 2017 purchase price. Meanwhile, Redfin pegged the estimated value at $942,976 during the same period. However, Chase arrived at a more conservative number: $881,800. A Tacoma, Washington, home that had a Zestimate of $658,000 went on the market, the home listed for $950,000 — a whopping 42% above Zillow’s ballpark estimate. This was due largely to the renovated home interior and waterfront location. (Yahoo)

* The bond market is already pricing in rate cuts, so the simple act of the Fed cutting is not necessarily going to have a direct impact on mortgage rates,” Alan Ratner, managing director for housing research firm Zelman & Associates “Right now, the bond market is already pricing in that outlook, so we’ll see how far rates actually move lower, but our view is it’s going to be a fairly gradual decline over the next several years, as opposed to a step function lower.”

* Scarsdale, NY is the wealthiest suburb in the US according to a new analysis with the average household income at $568,942 per year. Next is Rye, New York, then West University Place Texas, Los Altos, CA and Paradise Valley AZ. University PArk, TX, Hinsdale IL, Great Falls Virginia, Orinda, CA and Wellesley Massachusetts. Around 75% of the suburbs in the TOP 50 are located in states with high local state taxes.

* The National Park Service oversees historical designation of properties and advises that new additions should be clearly new additions and not give confusion as to whether they were part of the original structure, although they should be respectful of the historic fabric. When renovating an historic building to repurpose, or even update, as an investment property–residential or commercial–you may qualify for federal historic tax credits to reduce the cost of the renovations. Those tax credits will be denied if any additions are not done in compliance with Park Service requirements. Owner occupied homes are not eligible for the federal historic tax credits. Many states have instituted historic tax credit programs of their own,which might allow homeowners to use the credits for renovations, but generally follow Park Service regulations. If a developer is eligible for both tax credits, they can usually receive both, further helping to make the numbers work and preserve our architectural heritage. Thanks David Feldman of COMPASS Philadelphia for this info!

* Here are some expert’s wishlist items for a swell kitchen:

-The ability to hang pots that are easily accessed and reached.

-A deep, big sink that hides dishes.

-Natural light and good artificial lighting too

-A super efficient and well laid out pantry, either walk in or cabinet.

-A hole in the counter with a trash can below. (HOUSE BEAUTIFUL)

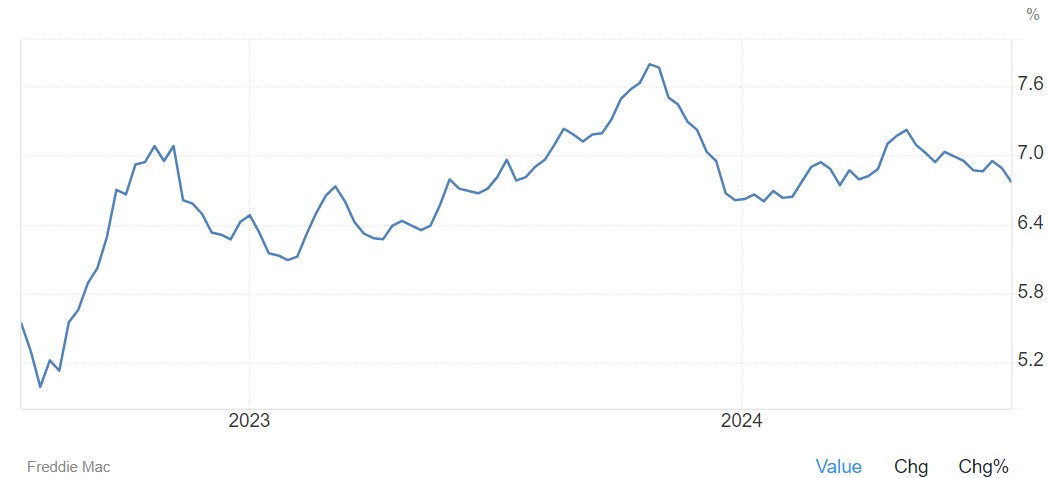

Mortgage Rate Updates

The average rate for a 30-year fixed mortgage fell sharply by 12 basis points to 6.77% as of July 18th, marking its lowest level since mid-March, according to Freddie Mac. This decline coincided with increasing dovish expectations for the Federal Reserve amidst recent signs of a weakening labor market and easing inflation pressures, alongside a drop in long-dated Treasury yields. A year ago, the average rate for a 30-year mortgage stood at 7.02%. “Mortgage rates are headed in the right direction and the economy remains resilient, two positive incremental signs for the housing market.” said Sam Khater, Freddie Mac’s Chief Economist. “However, homebuyers have yet to respond to lower rates, as purchase application demand is still roughly 5 percent below Spring, when rates were approximately the same. This is not uncommon: sometimes as rates decline, demand weakens, and the apparent paradox is driven by buyers making sure rates don’t decline further before they decide to purchase.”.

Source: Freddie Mac