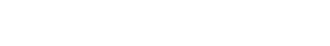

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 7/29/2024 – 8/5/2024

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* The 10-year Treasury is approaching 3,7%….. Crypto fell over 10% over night…..Oil fell below $72….Natural Gas below $2…..August Angst has arrived!

* The FED relies on lots of data. When it comes to housing, it looks to the CASE-SHILLER index…..Tuesday’s Case-Shiller data (for May) covered home prices changes over March, April, and May. It’s now August….two-plus months later…. (home-economics.us)

* Historically, the economy is already in a recession once the three-month average of the unemployment rate rises at least a half percentage point above its low in the past 12 months. That’s now happened. (Bloomberg)

* These are the 10 most expensive cities in the world according to a recent analysis:

Geneva, Switzerland

Zurich, Switzerland

New York, New York

San Francisco, California, United States

Boston, Massachusetts, United States

Reykjavik, Iceland

Washington D.C., United States

Seattle, Washington, United States

Los Angeles, California, United States

Chicago, Illinois, United States

* Here is how a 60/40 portfolio, tracking the entire U.S. stock and investment-grade bond markets, would have performed from 1926 through 2023:

Average annual return, 8.7%.

Worst calendar year, 1931, with a return of minus 26.6%, Best year, 1933, with a return of 36.7%.

– For comparison, here’s a pure stock portfolio with higher returns but lower lows:

Average annual return, 10.3%.

Worst calendar year, 1931, with a return of minus 43.1%, best year, 1933, with a return of 54.2%. (VANGUARD, NY TIMES)

* COMPASS National market share grew over 10% as of the second quarter of 2024 compared to a year ago.

Mortgage Rate Updates

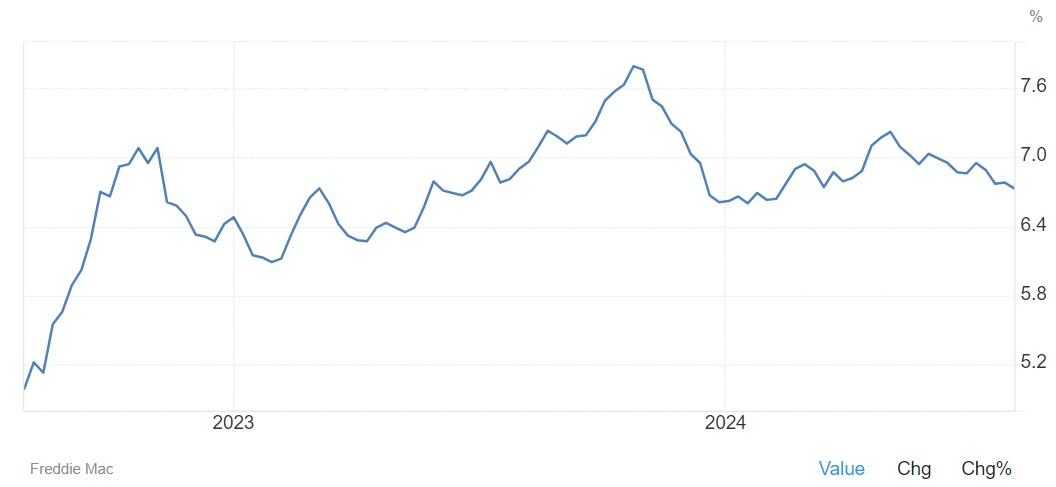

The average rate for a 30-year fixed mortgage decreased by 5 basis points to 6.73% as of August 1st, reaching its lowest level since early-February, according to Freddie Mac. This decline coincided with a significant drop in Treasury yields to six-month lows as markets assessed the Federal Reserve’s monetary policy outlook, with the central bank maintaining its funds rate in the 5.25%-5.5% range while hinting at potential rate cuts in September. A year ago, the average rate for a 30-year mortgage stood at 6.90%. “Mortgage rates declined to their lowest level since early February,” noted Sam Khater, Freddie Mac’s Chief Economist. “Expectations of a Fed rate cut coupled with signs of cooling inflation bode well for the market, but apprehension in consumer confidence may prevent an immediate uptick as affordability challenges remain top of mind. Despite this, a recent moderation in home price growth and increases in housing inventory are a welcoming sign for potential homebuyers.”.

Source: Freddie Mac