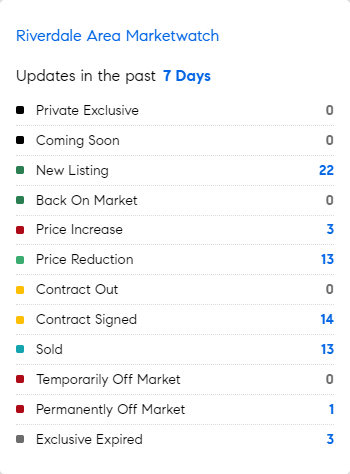

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 7/8/2024 – 7/15/2024

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* Boomtown Bust? A narrative is floating around that several areas around the US that experienced massive growth – and home price escalations – are about to go bust with sharp valuation declines. Before anyone surmise this they should acknowledge two things:

1. Prices soared and its natural that there will be some stabilizing and re-balancing after massive escalations in a short period of time. That is inevitable. Will prices decline to pre-pandemic levels? Very unlikely. Why? Replacement costs are way up and demand remains strong while inventories are mostly pretty stable.

2. If someone bought last year at a ‘high’, chances are they will not be selling for several years. Most stay in their home for at least 10 years…..with the average around 13 years.

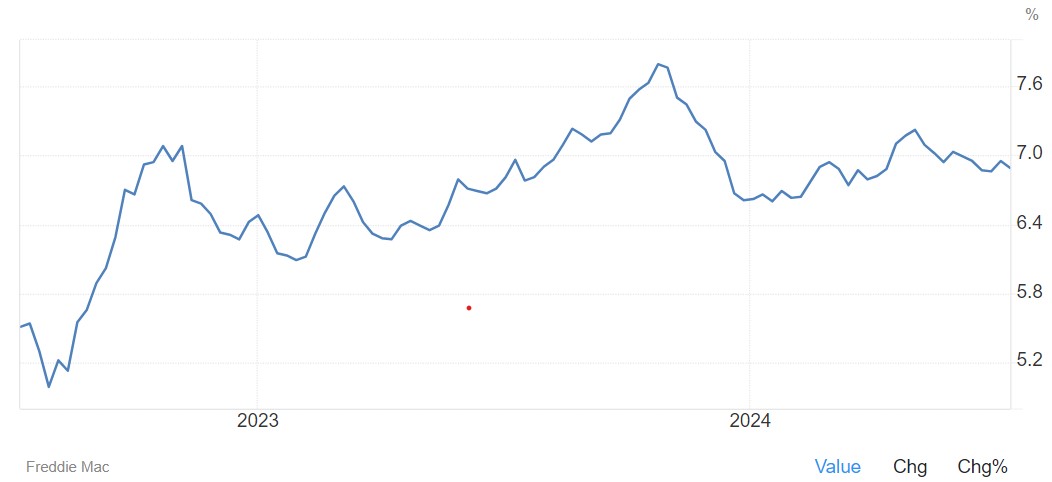

Mortgage Rate Updates

The average rate for a 30-year fixed mortgage dropped by 6 basis points to 6.89% as of July 11th, according to Freddie Mac. The move was aligned with a drop in long-dated Treasury yields in the period, prompted by a softening labor market in June that raised expectations of Federal Reserve rate cuts this year. In the same period last year, the average rate for a 30-year mortgage was 6.96%. “Following June’s jobs report, which showed a cooling labor market, the 10-year Treasury yield decreased this week and mortgage rates followed suit,” said Sam Khater, Freddie Mac’s Chief Economist. “There is also more inventory on the market, including a fair number of listings with price cuts, which is an encouraging sign for prospective buyers.”.

Source: Freddie Mac