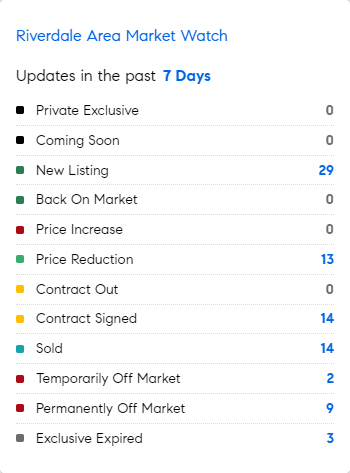

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 9/2/2024 – 9/9/2024

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* With inflation seemingly under control and weakness showing in the US labor market, officials are widely expected to drop their benchmark lending rate by at least a quarter percentage point when they wrap up a two-day gathering this coming Wednesday. This is bound to unshackle the world’s largest economy from a lengthy stretch of elevated borrowing costs and is likely to be accompanied by a signal from the Fed that it’s poised to provide more relief for American businesses and households over the coming months: that combination should keep in motion a repricing of trillions of dollars in global assets that’s already underway. (BLOOMBERG)

* Aside from the pandemic crash of 2020, the six recessions over the past 50 years pushed unemployment to an average peak of 8.6%. We are about half that right now.

* As of July 2022, roughly 46 million people, or 13.8% of the U.S. population, lived in rural areas.

* When designing a kitchen, placing a cooktop on an island can be risky…..hot pots and people hanging out at the island may not be best…. (WSJ)

* Large investors own 2% of UK private rental housing, versus 37% in the US. (FT)

Mortgage Rate Updates

The average rate on a 30-year fixed mortgage dropped to 6.2% as of September 12th, reaching its lowest level since February 2023, according to Freddie Mac. This drop reflects declining long-term Treasury yields as the Federal Reserve is anticipated to begin its rate-cutting cycle amid signs of a cooling labor market, with Fed officials Christopher Waller and John Williams expressing support for a cut in next week’s meeting. In the same period last year, the rate on a 30-year benchmark mortgage was 7.18%. “Mortgage rates have fallen more than half a percent over the last six weeks and are at their lowest level since February 2023,” said Sam Khater, Freddie Mac’s Chief Economist. “Rates continue to soften due to incoming economic data that is more sedate. But despite the improving mortgage rate environment, prospective buyers remain on the sidelines, as they negotiate a combination of high house prices and persistent supply shortages.”.

Source: Freddie Mac